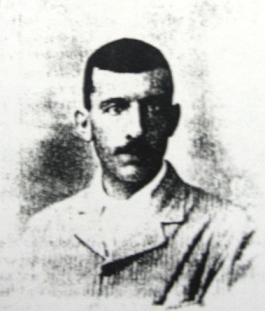

As 2008 – clearly an Annus horribilis for tens of millions around the world – draws to an end, we announce the Moving Images Person of the Year 2008: Danny Schechter.

Nicknamed “The News Dissector,” Danny is a television producer, independent filmmaker, blogger and media critic who writes and lectures frequently about the media in the United States and worldwide.

He has worked in print, radio, local news, cable news (CNN and CNBC), network news magazines (ABC) and as an independent filmmaker and TV producer with the award-winning independent company Globalvision. He is a blogger and editor of Mediachannel.org, a web and blog site that watches and critiques the print and broadcast media.

Another way to introduce Danny is to recall the scary headlines and TV news images that have dominated 2008 – of reputed banks going bust, leading stock markets crashing and these events triggering a global financial meltdown that, for now, has been slowed but not completely averted by unprecedented governmental intervention…by the very governments of the industrialised countries who should have kept a sharper eye on what was going on in their free market economies.

As the carnage on Wall Street and other global financial centres continued, some hard questions were asked: Did anyone see this coming? If so, why weren’t they listened to? What is the real cause of all this chaos? Where was the news media and why weren’t they doing their job of sounding the alarm?

Well, one man who saw it coming and tried very hard to raise the alarm was Danny Schechter. In 2006, as part of this effort, he made a documentary film called In Debt We Trust. In this, he was the first to expose Wall Street’s connection to subprime loans and predicted the global economic crisis.

This hard-hitting documentary investigated why so many Americans – college and high school students in particular – were being strangled by debt. Zeroing in on how the mall has replaced the factory as America’s dominant economic engine, Emmy Award-winning former ABC News and CNN producer Danny Schechter showed how college students were being forced to pay higher interest on loans while graduating, on average, with more than $20,000 in consumer debt.

The film empowers as it enrages, delivering an accessible and fascinating introduction to what former Reagan advisor Kevin Phillips has called “Financialization” — or the “powerful emergence of a debt-and-credit industrial complex.”

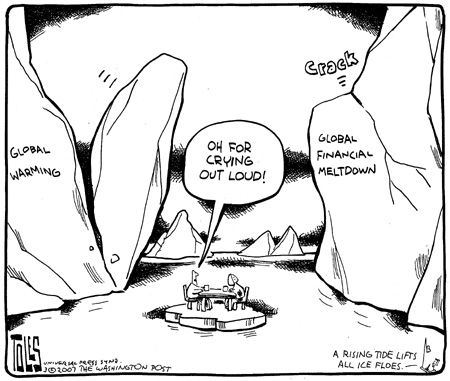

Danny and his film have done for global financial meltdown what Al Gore did for global warming with his own film: investigate rigorously, gather and present the evidence of a gathering storm, sound the alarm — and keep badgering until the warnings were heard. In both cases, the inconvenient truths they presented were ignored for too long — and we are paying the massive price for such indifference.

Watch the Trailer of In Debt We Trust:

Deborah Emin, writing in OpEdNews in October 2008, noted: “In Debt We Trust…brought Schechter a lot of grief. Rather than being seen as a prophet of doom, which in and of itself was not so terrible, he should have been lauded for sounding the alarm when it would have been in time. It is truly an amazing fact of American life that the powers that be can so disastrously determine what information we are able to see based on their subjective judgment of what is too negative or too harsh a view of a specific topic. From this perspective, we should judge all these gatekeepers as those on the Titanic who did not want to alarm the passengers that the ship was going down.”

Watch an extract from In Debt We Trust: How did we get into this mess?

Watch In Debt We Trust in full on Google Video

So here’s the trillion-dollar question: if this film was made in 2006, and has since been running to packed houses scaring a lot of thinking and caring people, why was its message not heard in the corridors of power in Washington DC — and elsewhere in the G8 countries’ capitals?

The short answer could be that there have been no thinking and caring people running the American government for the past eight years.

Plunder also offers an analysis based on current events, going behind the scenes, identifying the key players and culprits, challenging the financial industry, government deregulation — and the financial and most sections of the mainstream media who have been cheer-leading the financiers as the latter took ever larger risks. Danny also argues that this has been a criminal enterprise — a point only touched on in most media coverage — and of global significance, given the globalization of markets.

Read my Sep 2008 blog post: Financial Meltdown: Putting pieces together of a gigantic whodunnit

On a personal note, I have been a great admirer of Danny Schechter and his work since I first met him 13 years ago. In the Fall of 1995, he gave an inspiring and provocative talk to a group of journalists and producers from the developing world who were on a UN-organised media fellowship in New York. As part of our tour of media and development agencies in the US East Coast, we visited Danny’s GlobalVision productions.

Danny introduced himself as a ‘network refugee’ — one who had worked for the mainstream network television in the US and had left in disgust. From outside, he was trying to find alternative ways of speaking truth to power — the original mandate of the mass media which many corporatised media companies had abandoned, knowingly or otherwise.

In that pre-Internet era, Danny engaged in his media activism through independent filmmaking, through which he supported and often participated in struggles for social justice in his native United States as well as in places like apartheid-ridden South Africa and strife-torn Palestine.

Now in his 60s, Danny is simply indefatigable. Besides running MediaChannel and GlobalVision, he blogs every few hours, writes a regular column on Huffington Post, lectures on media, writes books and still has time to make investigative films. He is extremely well informed, witty, funny and completely irreverent. He writes and speaks with justified outrage but no malice. That’s a tough balance to maintain.

Danny visits Wall Street on 20 September 2007 – typical of his funny, incisive reporting:

I was delighted to catch up with Danny in May 2008 when we both participated in Asia Media Summit in Kuala Lumpur. He and I were in a small minority of participants who were familiar with the inner works of the mainstream media and transformational potential of the new media. In characteristic style, Danny stirred things up, livening the usually staid proceedings, and I did my best to back him up from the audience. We both enjoyed asking irritating – if not outright annoying – questions from the 400+ media mandarins and press barons who’d come together for the Summit.

One evening, Danny and I had a drink with Malaysiakini’s CEO and leading new media activist Prem Chandran where we talked about the slow but inevitable decline of the mainstream media dinosaurs — or what Michael Crichton called Mediasaurus. The trouble with mediasaurus, we agreed, was that they are taking a long time going extinct and for now, they still command significant numbers of eyeballs and the dollars that follow.

After Prem left, Danny and I continued our chat into the evening. Over a spicy Indian meal, Danny gave me a crash course on subprime crisis (or sub-crime as he calls it) and how that was going to have a domino effect on markets everywhere. I listened with growing comprehension — and deep admiration for the man’s ability to communicate complexities without oversimplification.

Events in the weeks and months that followed have shown how remarkably prescient Danny Schechter was. And what a monumental, global scale mistake it was not to have heeded this man’s cautions in his blogs, films, columns and elsewhere.

We end 2008 with my cartoon of the year. As I said in a blog post in September 2008: “This cartoon by Pulitzer prize winning Tom Toles first appeared in the Washington Post in 2007 – it brilliantly anticipated the global financial meltdown that we’re now experiencing. Coming in the wake of confirmed global warming, it is a double whammy.